XRP’s Role on Ripple and in the Internet of Value

November 2015

Why the World Needs Ripple

Payments don’t meet the expectations of 21st century consumers or the needs of an

inclusive global economy. They are the cornerstone of global economic activity. Yet, as

the modes of payment grow more inventive and more convenient (mobile, social,

machine to machine), the actual settlement of payments is mired in decades old

technology.

Think about the last time you sent an i nternational payment , in particular. Did it take days?

Did you understand the fees and foreign exchange rate? Was it expensive? Were you

worried it wouldn’t get there? Domestic payments encounter friction too, but

cross-border payments are the slowest and most expensive. The reason they’re so slow

and expensive is they’re beholden to antiquated and inefficient infrastructure, built

country by country, before the dawn of the Internet.

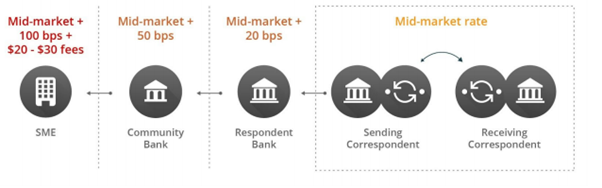

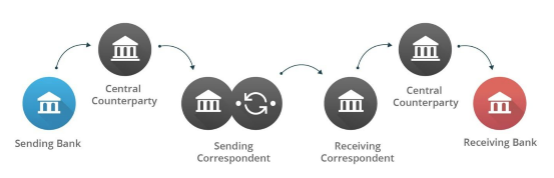

Today, payment networks are siloed. Correspondent banking connects networks through

a series of intermediary banks and central counterparties. Each intermediary adds cost,

obstructs visibility, and creates a potential point of delay or failure.

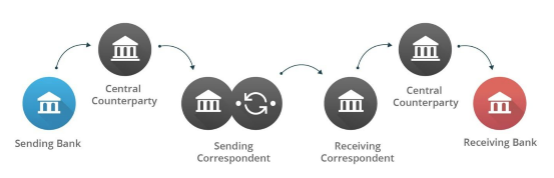

Correspondent banking is capital intensive for liquidity providers. It requires they have

global operations and hold liquidity in local currencies all over the world. Thus, fewer

than ten banks in the world provide liquidity for global payments, so FX rates aren’t

competitive. Then, each intermediary marks up the rate, so smaller banks and end

customers see worse rates.

The numbers are telling. On average, international payments take 2+ days to settle, 4

percent fail1, 12 percent result in errors2, and they create total costs of $1.6 trillion3

annually.

We believe payments, and more broadly value, should move like information moves on

the web today - globally, securely, instantly, freely. By design, this Internet of Value will be

built on open web standards (e.g. I nterledger Protocol) and involve the participation of

existing payment service providers (e.g. financial institutions, payment networks) and

new types of providers (e.g. distributed financial technology companies). These

standards and new distributed financial technologies will connect the world’s financial

systems - both new and old - so value will move across systems and borders with the

least friction possible, and so all participants can benefit from the economies of liquidity

at scale.

By modernizing the underpinnings of payments infrastructure with IP-based technology,

the Internet of Value will initially allow individuals and businesses to enjoy instant, lower

cost, secure cross-border payments, and payment service providers to enjoy greater

business opportunities. In the future, it will create access for the financially underserved

to affordable payment services, for individuals to tap into new sources of value, for

businesses to expand reach, for technology companies to innovate in presently

unimaginable ways, and for economies to grow exponentially.

1 Robinson, Edward. "Former Goldman Exec Wants to Upend the Way the World Moves Money." Bloomberg : n. pag. Web. 7

Apr. 2015.

2 "Does Valid Bank Account Data Matter?" Experian : 8. Web. 2014.

3 World Trade Organization, Federal Reserve Financial Services, Institute of International Finance, Ripple Analysis

How Ripple Can Spark the Internet of Value

To map how we get there, let’s look at how all successful Internet technologies, including

the Internet itself, took off. They built network effects, matching supply with demand. As

these marketplaces flourished, efficiencies increased, participants realized greater

returns, and experiences improved exponentially.

Every marketplace starts with a chicken-and-the-egg problem: the supply side won’t

come to the table or make significant change unless there’s demand. And, demand is

challenging to prove without real supply. The classic example is the telephone network -

a brilliant invention but pretty useless for the first phone owner, who had no one to talk

to.

How, then, does Ripple build network effects?

Let’s start by identifying the actors. When we evaluate how all payments work, they

ultimately require account-to-account settlement either within a bank or between banks.

Even if you use Venmo or Paypal to pay a friend or a merchant, you still ultimately rely on

banks to custody and move your money. Cross-currency payments require liquidity

provision, which top global banks provide today as discussed earlier. Then, in Ripple’s

marketplace, banks and third-party liquidity providers s upply payment services and

liquidity for individual and business customers, who have demand for payments.

What’s in it for banks?

Ripple offers, for the first time in history, the ability to transact directly, instantly and with

end-to-end visibility and certainty of settlement. These unique characteristics present

new business opportunities for banks to compete with upstarts.

For large, global banks, Ripple reduces risks and thus compresses operational costs4,

furnishing them the opportunity to leverage their existing FX operations to build

profitable low-value payment services, like remittances and disbursements, and increase

their wallet share.

For small to mid-sized banks, Ripple offers an entirely new, unbundled model for

cross-border payments. Ripple enables them to directly transact with other banks

globally, sourcing liquidity from an open marketplace of third parties and allowing them

to introduce competitive cross-border payment services to attract new customers.

4 Operational costs include treasury operations, processing and liquidity costs.

What’s in it for third-party liquidity providers?

Through its novel design, Ripple facilitates competitive bidding on liquidity provisioning.

Third-party market makers, such as hedge funds, enjoy access to an entirely new and

ever-growing opportunity to provide liquidity for global payments, profiting from

spreads.

What’s in it for individual and business customers?

Banks that adopt Ripple can offer their consumer and business customers improved

payment services that are faster, less expensive, and offer greater visibility into delivery

status.

Ripple leads the market today in delivering on the interbank cross-border payment use

case. Banks now adopting Ripple benefit from new efficiencies in payments processing.

To date, Ripple is the only provider of enterprise-grade solutions, tried and tested by

more than a dozen banks using real money. Ripple solutions are based on Ripple’s core

technology, which accommodates instant cross-currency settlement and is scaling to

process limitless throughput of transactions.

Out of the gate, Ripple injects an outmoded system with new processing efficiency,

creating immediate return on investment for first adopters. As a marketplace, benefits

grow exponentially as more participants join and as it becomes a thick market. Ripple’s

native digital asset, XRP, can help expedite market thickness on Ripple.

From a Spark to a Wildfire

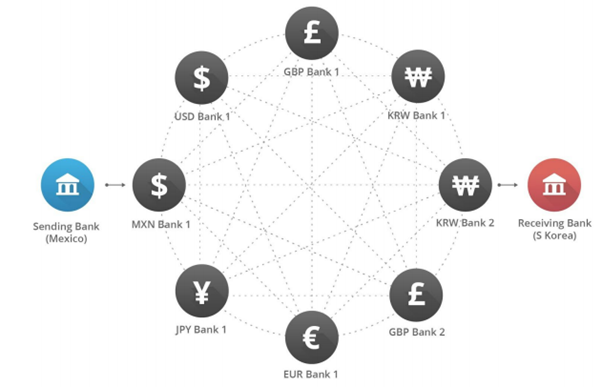

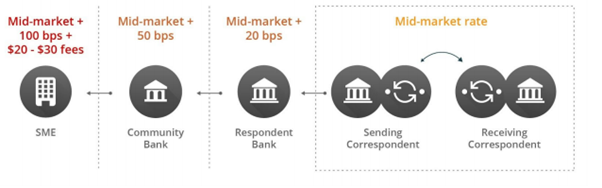

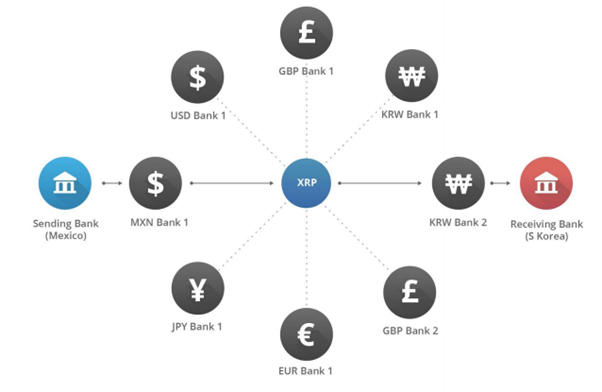

As liquidity on Ripple grows, so do the number of currencies and counterparties. In this

state, there will be many options to execute a currency trade. Liquidity providers need to

open and maintain accounts with each institution for each currency - a capital- and timeintensive

endeavor that spreads liquidity thin. It’s more challenging for the marketplace

to offer tight spreads with thin liquidity. In the example below with eight banks, a liquidity

provider would need to quote up to 28 currency pairs to participate in all order books.

Further, some options will involve many trading parties, who each layer costs to the

transaction, especially long-tail payments in exotic corridors. These complex paths make

competitive pricing challenging for long-tail payments.

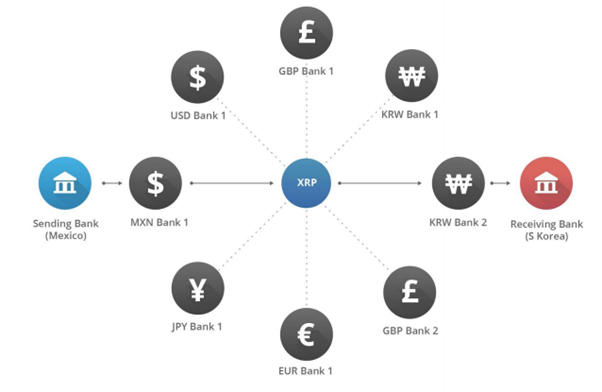

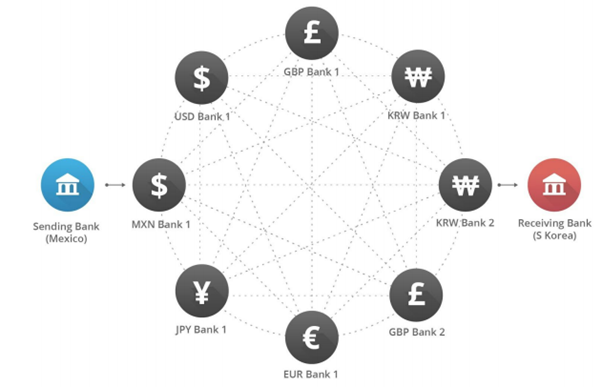

Ripple is uniquely positioned to solve these problems as a multi-currency distributed

financial technology with a native digital asset, XRP, that directly bridges any two

currencies. By using XRP, liquidity providers reduce operational costs and have the

opportunity to specialize in certain currency corridors. Similar to USD, XRP allows market

makers to concentrate their liquidity around fewer pairs, creating order book thickness

and competitive FX rates. Unlike USD, trading through XRP does not require bank

accounts, service fees, counterparty risk, or additional operational costs. In this example,

market makers collectively only have to quote eight currency pairs (versus up to 28 in the

previous example) to reach the same number of destination currencies.

Using XRP as a bridge asset, complex cross-currency payments can be executed without

additional trading parties, translating to lower costs for even exotic corridors.

XRP is an attractive asset for liquidity providers to create liquidity between any two

currencies at incremental cost. To offset the risk of bridging currencies with a new asset

like XRP, we plan to subsidize its use in the early days. With XRP, market makers

systemwide can offer tighter spreads than traditional currency markets, fast-tracking

Ripple’s path to market thickness.

This offer is immediately compelling to small to mid-sized banks, which today rely on

large correspondents to provide liquidity for cross-border payments. By sourcing liquidity

from third-parties who make markets through XRP, smaller banks can offer more

competitively priced payment services to attract new customers.

Initially, large banks will continue to source liquidity from their own FX operations and

improve their processing efficiency using Ripple. However, as Ripple’s currency market

grows, large banks will see benefit to posting and sourcing liquidity to and from it as well.

Conclusion

The advent of distributed financial technology has set the unfolding of the Internet of

Value in motion. As our CEO Chris Larsen says: “The genie is out of the bottle.” As with

any marketplace, the Internet of Value needs to first solve the chicken-and-the-egg

problem: attract both supply and demand.

As a uniquely positioned distributed financial technology, Ripple plays a key role initiating

network effects in the Internet of Value. In a marketplace context, Ripple affords liquidity

suppliers (banks and third-party market makers) and liquidity takers (people and

businesses who need payments) step-function improvement over how cross-border

payments work today:

- Large, global banks lower operational costs to increase wallet share.

- Small to mid-sized banks gain direct access to competitive liquidity to

attract new customers.

- Third-party market makers compete to provide liquidity for global

payments.

- People and businesses enjoy faster, less expensive payment services with

new visibility into tracking and delivery status.

The introduction of third-party liquidity providers significantly transforms the face of

payments and accelerates the growth of Ripple’s marketplace. The more participants in

liquidity provisioning, the more competitive the marketplace. Competition encourages

broader adoption and participation - in sum, network effects.

As a digital asset, XRP is a useful trading instrument to reduce spreads and expedite

market thickness. To incentivize early participation of liquidity providers, Ripple will

implement programmatic distribution of XRP to those who use it to offer better spreads

on currency trades and payments.

With clear and validated benefits to bring both supply and demand actors to the table,

Ripple’s marketplace is already developing: large banks are joining to improve processing

efficiency, and small to mid-sized banks are joining to leverage third-party liquidity

providers for cross-border payment services. As these network effects build, Ripple and

XRP will play a central role in driving development of the Internet of Value.